The International Grain Trade and the War

The Russian invasion of Ukraine has driven up grain prices, disrupted value chains and threatened grain supply of countries affected by hunger. There is a serious concern that Russia – the world’s largest wheat exporter – could exploit its power as a weapon of war. How are things looking in the global grain trade?

Translated from the German by Hillary Crowe.

In the last two decades, Russia turned from being an importer of wheat into its largest global exporter. Grain exports from Ukraine rose sharply at the same time. Russia and Ukraine together accounted for 30 per cent of wheat exports, 25 per cent of barley exports and 15 per cent of maize exports globally.

Russian wheat is exported mainly to the countries of the Middle East and North Africa, with Turkey and Egypt in the lead. They also go to sub-Saharan African countries, which are becoming increasingly dependent on food imports. Russian wheat accounts for 25 per cent of African imports in total, but Ukraine also exports a high volume of grain to Africa and competes with Russia here.

There has been a great deal of public debate about the possibility that Russia might utilise its grain exports as a weapon in the war against Ukraine. It was expected that Russia would reduce its wheat exports in order to intensify the political pressure on the Western countries. But have these fears been realised?

Frequent restrictions on Russia’s wheat exports

Countries around the world use food export restrictions as a crisis mechanism. Russia often scales back its wheat exports in order to protect its domestic markets from rising world market prices. During the food crisis in 2007/2008, for example, a wheat export tax was introduced for the first time, and in response to the 2010/2011 drought, an export ban was imposed (Figure 1). Since the Covid-19 pandemic, Russian wheat exports have been subject to an export tax, periodically supplemented by an export quota and ban on exports to the countries of the Eurasian Economic Union. Contrary to expectations that Russia would increase its wheat export tax following its invasion of Ukraine, the tax was actually reduced in July and September 2022 in order to improve the competitiveness of Russian wheat exports.

Reduced competitiveness

Russia is still exporting wheat to the import-dependent countries of the Global South, most of which have adopted a neutral stance on Russia’s war of aggression. The West’s major grain-exporting countries, which condemn the war outright, continue to compete with Russia on the global grain markets.

However, the capital controls imposed by Russia’s central bank, along with Western sanctions, initially led to a strong upsurge in the value of the rouble, resulting in a loss of competitiveness for Russian wheat on the international markets. What’s more, due to war-related risks, the costs of insurance for shipping in the Black Sea have increased. There is also a risk that importers of Russian grain will find themselves facing secondary sanctions. These increased trading costs – on top of the wheat export tax – have weakened demand for Russian wheat imports. There is thus a possibility that Russia will not be able to fully exploit the major export potential created by the record harvest in 2022.

These macroeconomic market conditions may have prevented the Kremlin from being able to use its wheat exports as a weapon of war, not least because the competitiveness of wheat from countries with high transport costs has improved. So while Russian imports into sub-Saharan African countries have decreased, wheat from Argentina and Brazil has become more affordable for these countries.

Ukrainian agricultural exports have gained momentum

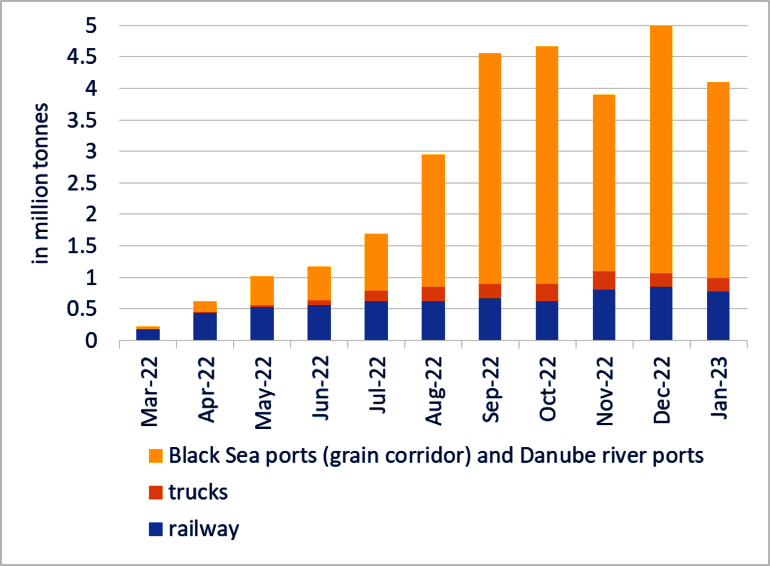

After the Russian invasion and the military blockade of Ukrainian ports, Ukrainian agricultural exports initially collapsed. However, alternative logistical arrangements were rapidly established on the basis of the EU Solidarity Lanes, with grain – mainly wheat, barley and maize – being exported by railway, by ship via the Danube river ports, and by truck (Figure 2). After the conclusion of the grain export deal between Ukraine and Russia in July 2022, Ukraine also resumed its agricultural exports via three of its Black Sea ports and the grain corridor. Grain exports from Ukraine rebounded to close to their pre-war level sooner than expected. However, transport costs have remained high and are one of the reasons why grain prices in Ukraine are well below the world market price.

Figure 2: Ukraine’s grain exports via the Solidarity Lines and the grain corridor

Africa’s declining wheat imports largely offset

In the key recipient countries for grain from Russia and Ukraine, the impacts of the war on the global food system have overlapped with the ongoing effects of the Covid-19 pandemic and the associated disruption of global shipping.

Since the war started, wheat imports from Russia and Ukraine into most African countries, particularly sub-Saharan Africa, have declined. By contrast, North African countries such as Egypt and Sudan, which maintain close political ties to Russia, have ramped up their Russian wheat imports.

In turn, wheat imports from other countries – particularly France and Bulgaria, but also Argentina and Brazil – have increased. These trade effects have largely offset the decline in wheat exports from Russia and Ukraine.

Even so, the risks in the global grain trade have risen sharply. The fear that Russia will use the grain supply chain restrictions as a weapon and that Western countries will continue to tighten their economic and financial sanctions has fuelled the rise in grain prices worldwide. There was also a concern that Russia would suspend the grain deal with Ukraine. Africa’s food security has therefore been affected less by supply issues and more by surging food prices. However, international wheat prices have now fallen back to their pre-war level, comparable to prices during the Covid-19 pandemic.

A renewal of the grain deal is essential

The current grain deal expires on 18 March 2023. Ukraine is calling for the deal to be extended for a further year and for more Ukrainian ports to be opened. At present, the clearance of ships by the Joint Coordination Centre in Istanbul has slowed, as occurred during the renewal negotiations in November 2022. The grain ships take five to six weeks to exit the Black Sea and there is currently a backlog, with 140 vessels in the queue. Due to the uncertainty surrounding the renewal of the agreement, traders are less willing to purchase Ukrainian grain, with the result that its price is falling. To prevent another rise in global grain prices, the renewal of the grain deal is therefore essential.

PD Dr. Linde Götz is Deputy Head of the Department of Agricultural Markets, Marketing and World Agricultural Trade at Leibniz Institute of Agricultural Development in Transition Economies (IAMO) and lecturer at Martin Luther University in Halle (Saale).