Western Assets in Russia: Navigating a Challenging Landscape

Russia’s war against Ukraine is not confined to the battlefield. Increasingly, the Kremlin is taking countermeasures in reaction to Western economic sanctions. It has set its sights on the assets of European companies in Russia, and their imminent seizure presents the EU with a dilemma.

In 2023, amid Russia’s full-scale invasion of Ukraine, the Kremlin has also shifted its focus from the battlefield to the economy. The numerous legislative activities around Western assets are clear evidence of this. A series of court decisions in Europe freezing Russian assets has prompted the Russian leadership to prepare for an escalation by establishing a legal framework for the nationalisation of foreign assets in Russia. This precarious situation has placed multibillion-dollar endeavours, which required years of arduous labour, in a state of uncertainty, as the Russian government contemplates a customised approach for each foreign investor.

In a move widely perceived as retaliatory, in April Russian president Vladimir Putin targeted the electricity assets of Finnish company Fortum, which is majority owned by the Finnish government, and of Unipro, which is owned by Germany’s Uniper. These assets were placed under the management of the Federal Property Management Agency, a decision explained by presidential press spokesman Dmitry Peskov as a response to the aggressive actions of unfriendly nations that seek to create a regulatory framework for the seizure of Russian assets abroad.

State-owned gas giant Gazprom had been among the first targets in the EU, with Gazprom Germania, which is responsible for 14 per cent of gas networks and 28 per cent of gas storage in Germany, placed under external management. In September 2022, Germany transferred state-owned Russian oil company Rosneft’s majority stake in an oil refinery in the northeastern town of Schwedt, along with minority stakes in two other refineries, to the control of a German federal agency.

These actions, taken because of the significant role these companies play in the German economy and the presence of a majority owner under sanctions, were aimed at ensuring the proper functioning of these assets. As transactions involving sanctioned entities are illegal, the risk of capital withdrawal loomed large. Rosneft made a legal challenge, but in March 2023 a court in Leipzig took the side of the German authorities.

Repatriating Russian assets

The Kremlin’s decision to de facto nationalise foreign assets did not arise spontaneously. Russian authorities and top businesses have been closely monitoring the fate of Russian assets in Europe. In anticipation of future events, major Russian companies, especially state-owned ones like the pipeline operator Transneft and the uranium producer Uranium One (a subsidiary of Rosatom), have already repatriated their assets from abroad to Russian jurisdiction. In March 2023, Putin instructed the Russian government to develop a plan, in collaboration with the parliament and leading business associations, to accelerate the transfer of business assets, particularly in key sectors, to Russia’s jurisdiction.

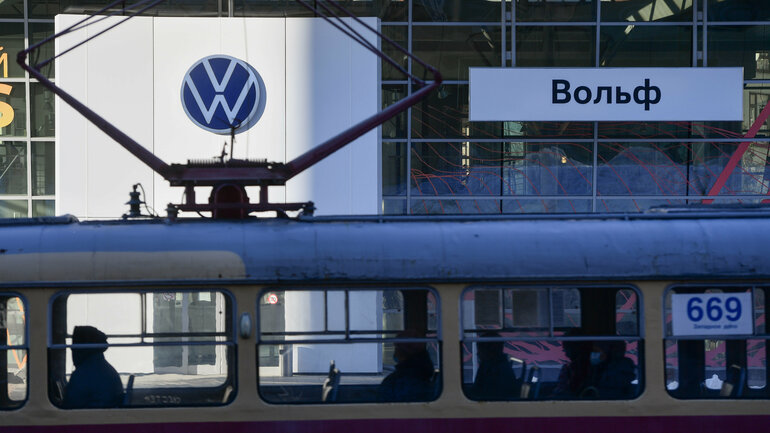

While Putin’s decree specifically targeted assets owned by foreign states, private assets in Russia are not entirely safe. Shortly after the Leipzig court’s decision, the arbitration court of the Nizhny Novgorod region ruled in favour of the Russian automotive plant GAZ, leading to the seizure of Volkswagen’s property in Russia. GAZ sought to recover losses of 15.6 billion roubles ($196 million) from Volkswagen for terminating an agreement on the contract assembly of cars in Nizhny Novgorod. Although the court has lifted restrictions on some of Volkswagen’s assets in Russia more recently and they were sold to a Russian buyer, a significant portion of the shares of foreign legal entities in Volkswagen Group Rus are still seized.

Under the new rules established by the Russian government, owners of foreign assets are compelled to sell their stakes at a 50 per cent discount and pay a 10 per cent donation of the assets’ value. The availability of buyers for attractive assets at discounted prices, particularly with the involvement of influential individuals in the Russian security apparatus (the siloviki), adds to the complexity of the situation.

In a report to Putin, Russian prosecutor general Igor Krasnov affirmed his office’s commitment to regaining state control over strategic enterprises. He further stated that his office is actively involved in assessing the alleged damage caused to Russia by the shutdown of enterprises with foreign owners. Subsequently, the Federal Property Management Agency may become involved in evaluating private assets based on specific criteria by calculating the economic harm caused by the cessation of operations and selling these companies after they are taken onto the agency’s balance sheet.

The West’s tricky balancing act

Significant assets of German companies and firms from other ‘unfriendly’ countries remain in Russia. In the energy sector, Western companies hold shares in joint ventures with Russian companies, such as BP’s share in Rosneft, Wintershall Dea’s and Austrian oil and gas company OMV’s shares in joint ventures with Gazprom, and shares of Japanese companies in oil and gas projects on Russia’s Sakhalin island. In the industrial sector, Volkswagen, Zeppelin Group, Bayer, and retail brands still have assets in Russia. Western firms find themselves in an increasingly challenging position: on the one hand, they have to navigate both regulation and the siloviki; on the other, if they try to withdraw by selling their stakes in Russian companies to Russian owners connected to the state or sanctioned persons they may be seen to be supporting the Russian war effort.

Given these intricate circumstances, it is imperative for the EU to develop a comprehensive and sustainable strategy to address the issues surrounding European companies’ assets in Russia. Such a strategy should encompass legal, political, and economic considerations with the aim of safeguarding the interests of these firms. For the Western companies involved, the solution could lie in developing legal mechanisms for asset swaps with Russian companies. It would also be wise to create a pool of investors interested in withdrawing assets from Russia, as well as various schemes for exchanging their assets for liquidity tied up in Russia in accounts allocated to non-residents (‘C-type’ accounts). And governments should look into the possibility of providing regulatory relief for companies whose net write-down of Russian assets worsens their balance sheets.

Alexandra Prokopenko is a researcher at ZOiS. She is an expert on Russian economic and monetary policy and the Kremlin’s decision-making processes.